|

|

![logo_main[1]](HTP%20fall%2008k_files/image001.gif) “$35 More Per Head?” Here’s the Study That Backs Up the

American Angus Association’s New Ad Campaign

“$35 More Per Head?” Here’s the Study That Backs Up the

American Angus Association’s New Ad Campaign

By Karol Fike

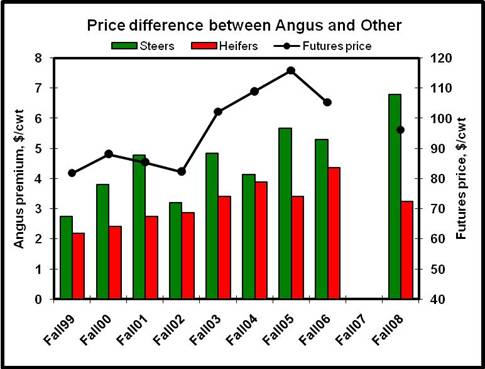

Premiums on Angus-based steer calves set a 10-year record last fall, despite a sagging economy and slumping prices for commodity calves. High-percentage Angus steers netted an extra $34.51 per head over non-Angus contemporaries at auction, smashing previous records, both per hundredweight (cwt.) and per head (see Figure 1).

That’s according to

“Here’s the Premium” (HTP), a long-term study initiated by

Certified Angus Beef LLC (CAB) in 1999. “The project compares prices for

Angus versus non-Angus calves and feeders at auction markets across the

The decade of data includes

information on more than 12,000 sale lots representing 270,220 cattle sold at a

dozen locations from Kentucky to California. From the start,

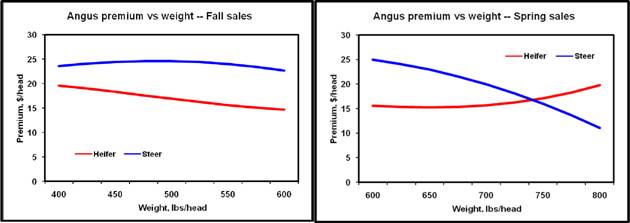

Fall surveys compare prices for 500-pound (lb.) calves, while spring surveys examine prices of 700-lb. feeders. Angus heifer premiums tend to hold stronger at the heavier weights. “If you just look at these 500-weight calves, it may appear that Angus heifers are lagging behind Angus steers in their ability to earn premiums,” Suther notes. “But this weight class represents the point where steer premiums have been at their widest relative to heifers (see Figure 2).

“By contrast, the Angus heifers really begin to pile on the premiums when they reach the 700-lb. area. At 725 lb., heifer premiums typically equal those of steers and at higher weights, the Angus heifer brings in more dollars over non-Angus than do Angus steers,” he says. “That could be due to the dual purpose nature of high-quality Angus heifers as either replacements or feeding animals that will require fewer days on feed than steers at that point.”

Looking back on 10 years, Suther notes that the premium for Angus steers and heifers more than doubled compared to the first few years of data. That progress came as all cattle were trending higher.

“When all cattle were trading at the top, Angus steers led the way,” he says. “They still do, because they deliver predictable and above-average gain and feed conversion, and bring home more premiums on packer grids that pay for pounds of high-quality beef.”

HTP project coordinator since its inception, Suther adds, “With so much uncertainty in virtually all markets now, buyers increasingly appreciate the dependability of today’s Angus genetics. If we could dig deeper into the very top premiums, we would probably also find that bidders have past experience with those sets of calves.”

Auction market managers agree that’s a factor. One commented, “Reputation cattle will sell. Buyers want calves they know will gain well and grade.”

The market managers report prices on groups of calves they personally

know to be of high-percentage Angus genetics, versus those that they know do

not carry Angus genetics. Additional factors such as known weaning and health

management and calf fleshiness are also reported.

Positive comments on calves sold such as “weaned,”

“fancy,” or “preconditioned” were associated with a

$1.88/cwt premium in the fall auctions. On the other hand, “thin,”

“not weaned” or “fleshy” were terms that went along

with discounts averaging $4.71/cwt. The

The fall 2008 data set included 521 lots of calves marketed in October and November, accounting for 9,705 steers and heifers. While Angus-based steers weighing 509 lbs. captured a record $6.79 cwt premium last fall, buyers also paid an added $3.24/ cwt for 501 lb. high percentage Angus heifers compared to their non-Angus counterparts. That’s $16.21/head in added value over non-Angus heifers, consistent with the average fall Angus-based heifer premium of $16.66/head over the course of the study. Historically, fall-marketed Angus-based feeder steers have netted $24.33/head in premiums.

###

Figure 1

Figure

1: Price difference between Angus and Other, Fall

1999-2008

Ten years of data representing more than 270,000 feeder calves reveal fall-marketed, 500-lb. commercial Angus steers have received an average $24.33/head ($4.87/cwt.) premium, while Angus heifers have garnered an extra $16.66/head ($3.33/cwt.). Futures prices peaked in fall 2005, but the most recent fall steer premium of $6.79 represents the record Angus advantage at auction.

Figure 2

Figure 2: Steers vs. Heifers, 1999-2008

Model-estimated premiums from HTP data show the strongest Angus steer premium, relative to all other calves, is at the 500-weight area, but heifer premiums catch up and surpass steer premiums at heavier weights.